The prices of stocks and real estate tend to be closely correlated – and you know what’s been going on with the stock market. But a downturn in stocks is not the only reason to be worried about real estate. Our Elliott Wave Theorist recently commented on an FHA scheme which has eerie similarities to yesteryear’s subprime housing bubble:

The Wall Street Journal discovered that the Federal Housing Administration has been allowing people who cannot afford monthly payments on FHA mortgages to remain in houses payment-free. The extent of the scheme is massive and explains why home prices have levitated despite high mortgage rates and stagnating home sales.

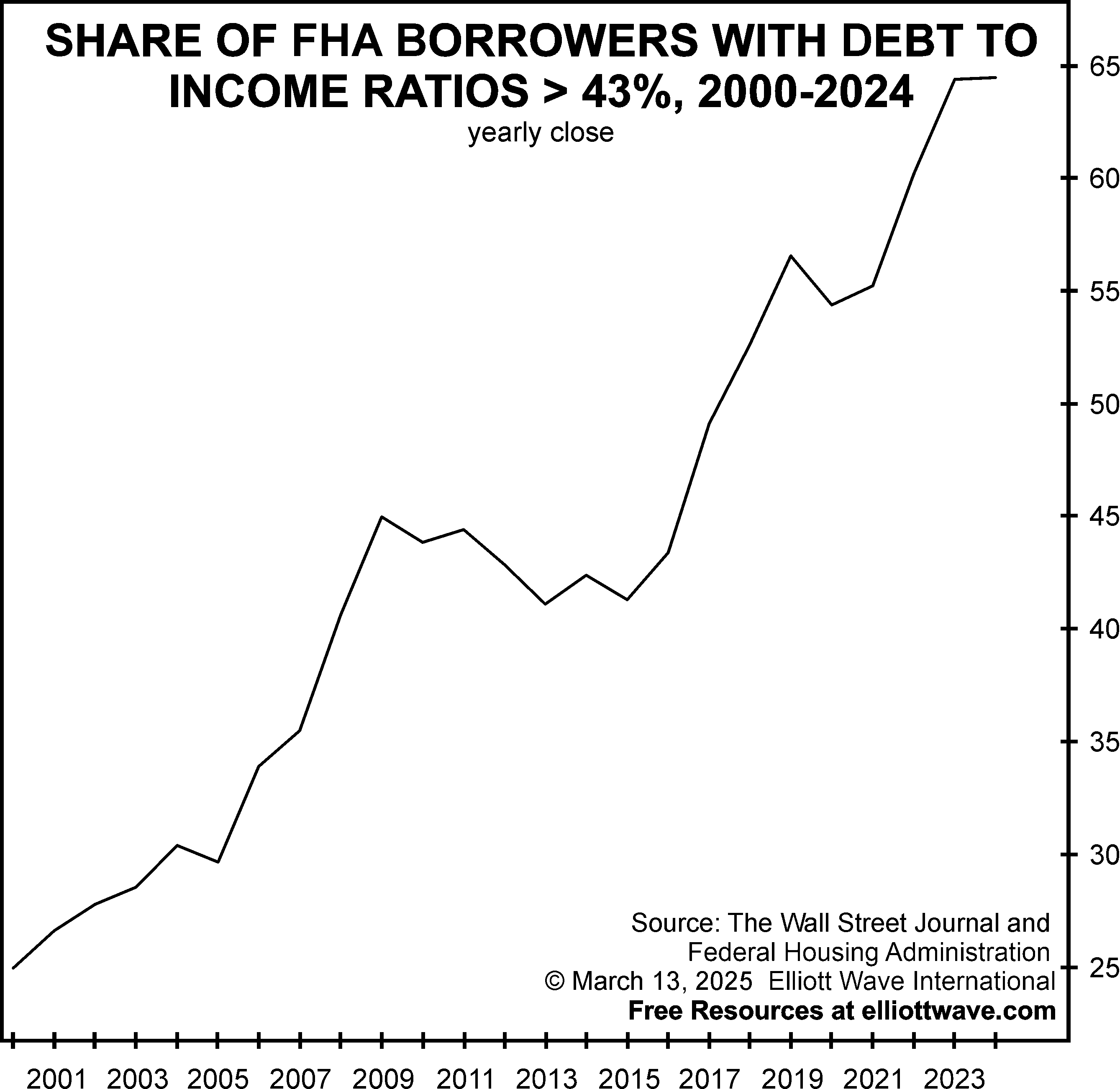

The percentage of bad-quality FHA loans has soared from 25% to 65% over the past 25 years, as shown in the chart below, taken from the WSJ article:

The WSJ also explains why a halt in the program would create a price-reduction spiral:

“If [government] officials dare to end the mortgage giveaways, foreclosures would inevitably increase, which could cause home prices to fall sharply in lower-income neighborhoods with more FHA mortgages. More borrowers would then fall underwater, ballooning taxpayer losses.”

One way or another, the outcome is inevitable: a crash in home prices.

If a period of global debt deflation is on our doorsteps, are you prepared for this rare event? Now is the time to get our in-depth analysis of what we anticipate next by reviewing our flagship services, which includes The Elliott Wave Theorist:

If you’re not ready to subscribe, read our special report: Preparing for Difficult Times. It’s FREE.