At first blush, extraordinarily low volatility in financial markets would seem to be a welcome development to investors.

No stomach-churning trading days – no sleepless nights, etc.

Indeed, on March 25, a Wall Street Journal headline asked:

Why Is the Stock Market So Calm Lately?

At that time, measures of market volatility had dropped to levels not seen since 2018. And just a few days before that headline, the Dow had hit a record high.

Ironically, however, just as a major financial publication commented on the lack of volatility, volatility then proceeded to pick up.

Here’s a more recent headline (Marketwatch, April 15):

Demand for volatility bets soars to 6-year high as Wall Street’s ‘fear gauge’ hits 2024 peak

So, the reason for being leery of super quiet markets is that they generally precede chaotic market action.

This not only applies to the U.S., but around the globe. Consider the STOXX Europe 600. As the index extended its rally to seven straight weeks in March, investor fear was very low.

However, our April Global Market Perspective provided a warning by showing past periods of low volatility which were followed by just the opposite. Here’s a chart and commentary:

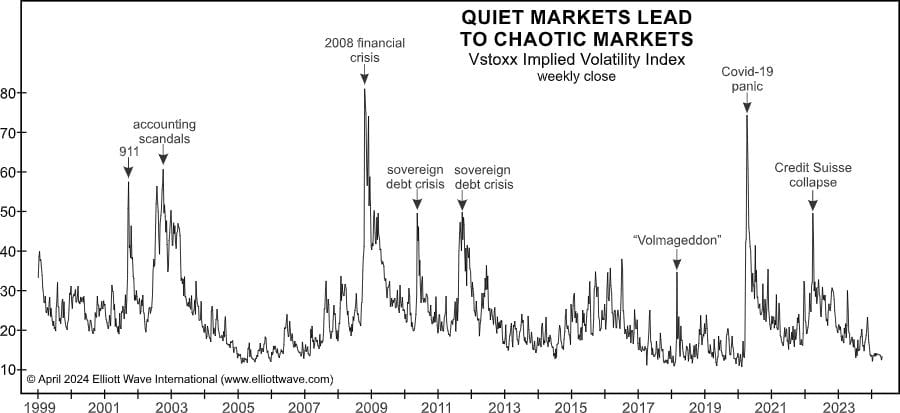

This chart of Europe’s VIX equivalent, the VStoxx Implied Volatility Index, illustrates a few of the infamous volatility spikes over the past quarter century.

In our view, today’s short-volatility casino is a much larger version of 2018. Five years ago, traders were gambling with a little more than $2 billion within a small handful of funds. Today, a record $64 billion is being bet using “ETFs that sell options on stocks or indexes in order to juice returns” (Bloomberg, 3/10/24).

Clearly, many investors in European markets are counting on markets to continue to function smoothly. However, keep in mind that in just a matter of days, the volatility spike during 2018 erased gains that were accumulated over dozens of months.

Today, much more money is being wagered compared to 2018. This suggests that the next spike in volatility may be even more dramatic.

Now is the time to get our detailed analysis of European financial markets, as well as dozens of other markets around the globe.

Europe’s “Fear Index” VIX Equivalent: Why “Quiet” Spells “Dangerous”

Here are some “infamous volatility spikes over the past quarter century”

Just a couple of months ago, stock market investors in the U.S. and Europe were exhibiting an almost total lack of worry toward risk. Yet, ironically, those are the very times when investors should be the most cautious. This chart shows when spikes in volatility are most likely to occur.