Letting you know upfront that you can add the rest of the world to your regional coverage for just $30 more per month. This video provides an example of what you’re missing.

And we’ll start by establishing what is meant by a “nonconfirmation” in the stock market.

For instance, let’s say that a couple of home builder stocks are hitting new highs while most of the rest of the sector is declining. Simply put, those declining home building stocks are failing to “confirm” the strength of the stocks which are hitting new highs. Hence, this is a sign that trouble may be ahead for those advancing stocks.

Or let’s say that the NASDAQ is hitting new highs but the S&P 500 index is woefully lagging behind. The S&P 500’s underperformance or nonconfirmation may be a sign that the NASDAQ will also eventually falter.

Now let’s look at Dow Theory, which has been around for more than a century. This indicator was created by Charles Dow, a cofounder of the Wall Street Journal and Dow Jones Industrial Average. Dow Theory involves two indexes: the Industrials and the Transports.

Here’s a summation from our June Global Market Perspective:

Dow Theory is a foundational concept in technical analysis that requires that price movement in industrial stocks and transportation shares confirm one another. A bearish nonconfirmation is said to occur when one sector makes a new high absent the other.

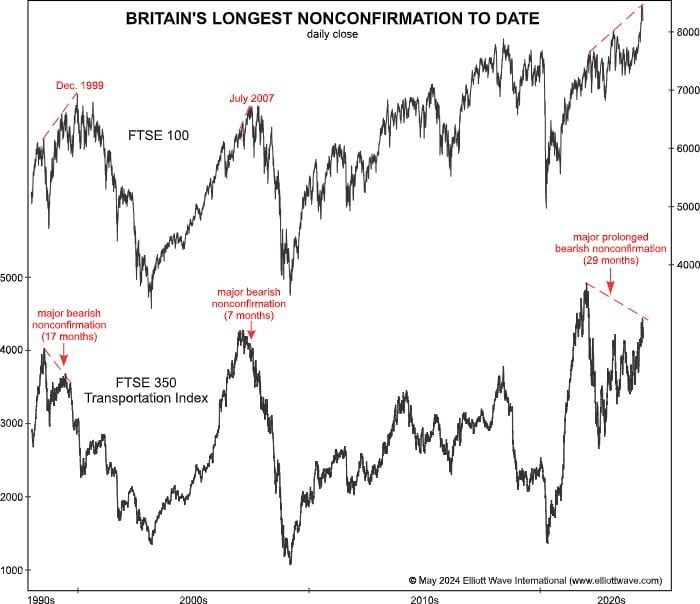

With this definition in mind, let’s see what our June Global Market Perspective has to say about Britain’s equivalent of Dow Theory via this chart and commentary:

The FTSE 100’s divergence with the FTSE 350 Transportation Index just pushed to 29 months, a far more prolonged Dow Theory nonconfirmation than July 2007 (seven months) or December 1999 (17 months). In 1999, the FTSE 100 eventually collapsed 53%, while the transports fell 66%. In 2007, the resulting declines were 49% and 77%, respectively.

Even though Dow Theory is associated with the Dow Jones Industrial Average and Dow Jones Transportation Average in the U.S., its concepts are universal and can apply to other global indexes.

Getting back to Britain, the current nonconfirmation doesn’t mean the FTSE 100 will dramatically decline immediately. However, it does suggest that when the decline does happen, it may very well be quite dramatic.

Look at all the indicators which our June 2024 Global Market Perspective offers. That way, you can prepare for what our 15-plus global analysts anticipate next for stock indexes, individual stocks, ETFs, cryptos, forex, interest rates, metals and energy. Remember, you can add our Global Market Perspective to your subscription for only $30 per month by following the link below.

Be Aware of Britain’s Longest Nonconfirmation to Date (Video)

Let’s look at the FTSE 100’s divergence with the FTSE 350 Transportation Index

Dow Theory was created more than 100 years ago and is associated with the Industrials and Transports in the U.S. Yet, the concepts of the theory are universal and can apply to other indexes around the globe. Here’s a case in point.

Add Global Market Perspective to Your Subscription

Only $30 More Per Month

The June 2024 issue of GMP gives you the Elliott wave patterns and trends in the world’s most traded markets.

This includes stock indexes, individual stocks, ETFs, forex, cryptos, interest rates, metals and energy.

Follow the link below to add GMP to your subscription for only $30 more per month.