“2023 bankruptcies have already exceeded the total for every full year since 2010”

Most people are probably unaware of the extraordinarily high number of U.S. companies which have bitten the dust so far this year.

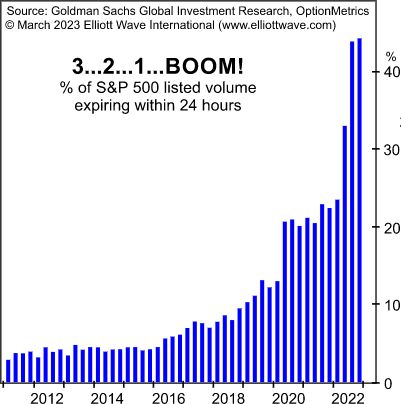

Our June Elliott Wave Financial Forecast showed this chart and said:

Bankruptcy is back: “The increase is most visible among large companies, where there were 236 bankruptcy filings in the first four months of this year, more than double 2022 levels, according to S&P Global Market Intelligence.” This chart shows that 2023 bankruptcies have already exceeded the total for every full year since 2010. [emphasis added]

Now, another one bites the dust — and this company has been around for 99 years (AP, July 31):

Teamsters say trucking giant Yellow Corp. is ceasing operations, filing for bankruptcy

Yellow Corp. owes a lot of money. As the article notes, the firm has debt of about $1.5 billion. A sizeable portion of that is owed to the U.S. government. In 2020, the Treasury Dept. provided the company with a $700 million pandemic-related loan. That loan is due in September 2024. As of March, Yellow had made $54.8 million in interest payments and repaid just $230 million of the principal owed.

And, speaking of the pandemic-era, this recalls an excerpt from the May 2020 Elliott Wave Theorist, which warned of debt and more business failures:

Why Businesses Are Failing

Neiman Marcus just declared bankruptcy. After only two months of social distancing? Why didn’t the company just reduce salaries or close its doors and reopen later?

The answer is: Before the virus hit, Neiman Marcus was in debt to the tune of one billion dollars. Debt must be serviced. The stores had to stay open every working day just to pay interest to the company’s creditors. A few down weeks, and the entire operation was in danger of becoming the property of creditors. Creditors don’t know how to run a business. All most of them know how to do is liquidate assets as fast as they can to try to get some of their money back. Under Chapter 11, a business can “restructure,” which means to stop paying interest to creditors, “temporarily.” But the crisis is not over, and what is deemed temporary today is likely to become permanent. When IOUs become anything less than fully paid, that’s deflation…

How many more bankruptcies will occur? Answer: lots of them… As Conquer the Crash warned well before all this happened, there is too much debt. [emphasis added]

Prepare now for what Elliott Wave International expects is ahead.

Learn how to access The Elliott Wave Theorist and the Elliott Wave Financial Forecast by following the link below.

You Can Know What All of Wall Street Wants to Know …

… Namely, “What’s driving the stock market now?”

That’s the question Wall Street money managers and Main Street investors alike want answered.

The problem is: Most speculators look to the headlines for their answer. They’re searching for the “trigger” that reveals the direction of prices.

Yet EWI’s extensive research reveals that news does not drive the stock market’s trend.

What does?

The answer is: collective investor psychology. That’s the insight that every investor, whether on Wall or Main Street, is seeking.

You see, Elliott waves reflect the repetitive patterns of this collective psychology. In other words, when an investor knows the message of the stock market’s Elliott wave pattern, that investor can prepare for what’s next with a high degree of confidence.

Learn what our subscribers know about the Elliott wave pattern of the main stock indexes by following the link below.

Financial Forecast Service

$97

All month long, Financial Forecast Service helps you stay ahead of the waves in the U.S. markets on the timeframes that matter the most. FFS covers the stock indexes, bonds, gold, silver, the U.S. dollar, as well as market psychology and cultural trends. It is our most popular service.

Comprises the monthly Elliott Wave Financial Forecast, 3x-per-week Short Term Update and at least 12x-per-year Elliott Wave Theorist.