“Social bonds offer the worst of both worlds”

Back in 2020, ESG bonds were all the rage. (Of course, “ESG” stands for Environmental, Social and Governance.)

However, some observers were less than enthusiastic about these bonds, pointing to their complexity and lack of liquidity.

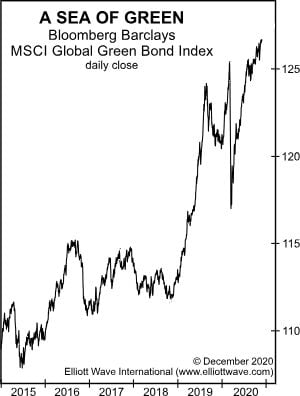

As Dec. 2020 rolled around, our Global Market Perspective showed this chart and said:

The euphoria surrounding this new debt is actually one of the biggest reasons to remain skeptical… Low interest rates have pushed desperate investors to buy debt from weaker borrowers (exposing them to nonpayment) or to buy longer-dated debt (exposing them to rising interest rates). Social bonds offer the worst of both worlds.

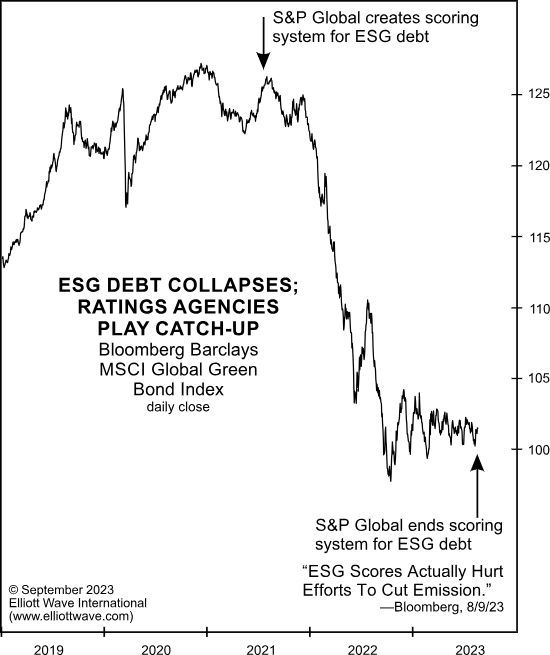

Since then, ESG debt has collapsed. Here’s a chart and commentary from our just-published September 2023 Global Market Perspective:

On August 10, S&P Global finally ended its practice of publishing scores for environmental, social and governance initiatives (ESG), citing negative investor feedback, general confusion and a lack of consensus on how to assess ESG factors. Ratings agency decisions always come after market participants have established a new trend. In this case, S&P introduced its ESG scoring system in September 2021, when the Bloomberg Barclays MSCI Global Green Bond Index was still flirting with its all-time high. A year earlier, we warned subscribers to steer clear of ESG bonds.

Here in the late summer of 2023, the sentiment towards ESG initiatives has clearly turned.

Even academia has expressed a negative view, as this Aug. 10 Bloomberg headline conveys:

ESG Scores Actually Hurt Efforts to Cut Emissions

ESG bond investors are not the only ones to take a shellacking.

Since March 2020, when interest rates began to rise, the value of negative-yielding debt has gone from $18 trillion to zero. Ouch!

Investors in ultra-long-dated debt, as well as commercial real estate bonds, have also taken it on the chin. And even people who aren’t familiar with the world of high finance know about the skyrocketing rise in mortgage rates.

Get our latest outlook on bonds, the FTSE, the pound and more in our just-published “UK Investor Report.” Learn more by following the link below.

“Dramatic Autumn Season” Directly Ahead

September (and October) are often the most treacherous time for investors.

“…the final quarter of 2023 could become one of the most volatile in recent memory,” according to EWI’s just-published UK Investor Report.

But there’s more to the likely volatility than just seasonal tendencies.

Across multiple markets, Elliott wave patterns of investor psychology are showing a rare convergence.

Read the new UK Investor Report to be ready for what’s next in the UK’s biggest markets — including stocks, bonds, currencies and more.

Get the report now.