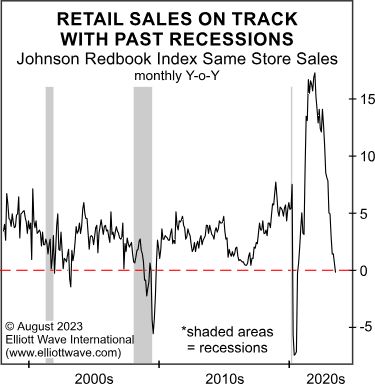

“The chart shows a year-over-year, rock-like descent”

It wasn’t so long ago that nearly every economist and his uncle was saying that a U.S. recession was just around the corner.

Now, at least one major Wall Street firm is saying that there’s a high chance that a recession will be avoidable (Fortune, Sept. 5):

The odds of a recession are now just 15%… Goldman Sachs says

Of course, only time will tell if a recession is in the cards during the next 12 months or not.

All the while, our Elliott Wave Financial Forecast has been doing some analysis of its own. The publication regularly reviews dozens of indicators related to the economy and financial markets and here’s just one which was discussed in the August issue:

The belief in a “strong consumer” is another widely held assumption among economists. But there are signs of rapid deterioration here as well. The monthly chart of the year-over-year change in Johnson Redbook Index Same Store Sales turned down from a soaring record high of 17.3% on December 25, 2021. That was within a few days of the all-time high in the S&P and Dow. The rally in stocks appears to be having no effect, as the chart shows a year-over-year, rock-like descent in same-store sales to negative levels in July. [emphasis added]

This cut back in shopping may become even more pronounced. Here’s a Sept. 2 news item from Fortune:

American families may soon max out their credit cards, top analyst warns, and be hung out to dry

Struggling U.S. families covering their living expenses with credit card loans may soon run out of options, an analyst has warned, saying a spending correction is on the cards. [emphasis added]

Here’s our analysis of another economic indicator from the August Elliott Wave Financial Forecast:

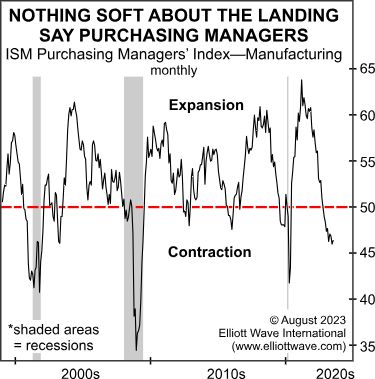

The chart shows a steady deterioration in manufacturing. A decline below 50 in the Institute for Supply Management’s Purchasing Managers’ Index indicates a contraction. The PMI fell fast, from a high of 63.8 in March 2021 to below 50 by November 2022. The chart shows the decline is similar to the ones preceding the last three recessions. Here too, employment is wavering. ISM reported that manufacturing employment contracted in June with a 48.1 reading. In July, the figure cratered to 44.4. The ISM service sector PMI is still above 50, but the service sector survey tends to follow the manufacturing PMI. In 2001, 2008 and 2020, the service PMI started to contract only after recessions were in place.

Here’s what you need to know: “recession” might be too mild of a description of what Elliott Wave International anticipates.

Get our complete analysis by following the link below.

4 Decades of Market Observation — and Counting

Most people who plan to traverse treacherous terrain want an experienced guide.

The reason is obvious: A guide has “been there, done that” and can help you avoid danger.

The same applies to financial markets.

Our analysts have been serving subscribers since 1979 and offer financial insights that you will not find anywhere else.

Get our Elliott wave experts’ latest outlook for U.S. stocks, bonds, gold, silver, the U.S. Dollar, the U.S. economy and more by following the link below.