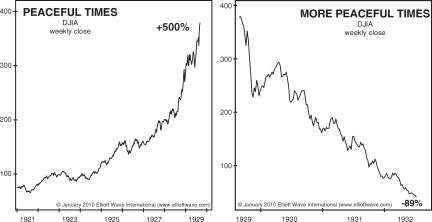

These two charts provide food for thought

There are several long-held assumptions about the stock market which are simply untrue.

In his landmark book, the Socionomic Theory of Finance, Robert Prechter reveals 13 of these market myths which trick investors into making decisions which harm their portfolios. You can read them all for free by following the link below.

All these myths have to do with so-called “fundamentals” or news and events which are believed to have a causal effect on the stock market.

But even events as big as major wars are shown to have no consistent causal effect on stocks. Indeed, our research reveals that U.S. stock market values have trended both up and down during times of large-scale military conflicts.

How about the opposite of war – namely, peace? Surely this must be bullish for stocks – or so many investors believe.

Economists might say that peace allows companies to innovate and compete without hindrance, which would be good for the overall economy and hence, a positive for stocks.

Yet, as the Socionomic Theory of Finance shows, peace appears to be a non-factor in determining the trend of the stock market. Here are a couple of charts along with commentary:

[The chart on the left] provides an example from the 1920s in which stock prices seemingly benefited from peaceful times. The Dow rose over 500% in just eight years as peace mostly reigned around the globe.

[The chart on the right], however, shows that in the three years immediately thereafter, peace likewise mostly reigned around the globe yet stock prices fell more than they had risen in the preceding eight years! It seems that we cannot count upon any consistent relationship between peaceful times and stock prices.

This is only one of the 13 market myths that you will find as you access Chapters 1 and 2 of the Socionomic Theory of Finance for free by following the link below.

Read The Socionomic Theory of Finance Now

Learn About 13 Investor Myths You’re Probably Falling For

- Positive corporate earnings will cause the stock to rally.

- Higher bond yields cause stocks to drop.

- Inflation causes gold and silver prices to rise.

99% of investors hold these irrefutable truths so tightly that they’re willing to invest hundreds-of-thousands of dollars based on these correlations. They never challenge whether they are actually true…

…but Robert Prechter does.

In his groundbreaking text, The Socionomic Theory of Finance, Prechter delves deep into history to study the most popular market cause-and-effects touted by economists, news outlets and brokers.

Read the first two chapters now for free and discover 13 dangerous investor myths.