The default for 90%+ of all financial punditry is to attribute market moves to the latest news. It’s lazy – and it’s usually wrong. Robert Prechter addresses the fallacy of exogenous cause and rational reaction in his book, The Socionomic Theory of Finance. Here’s an excerpt:

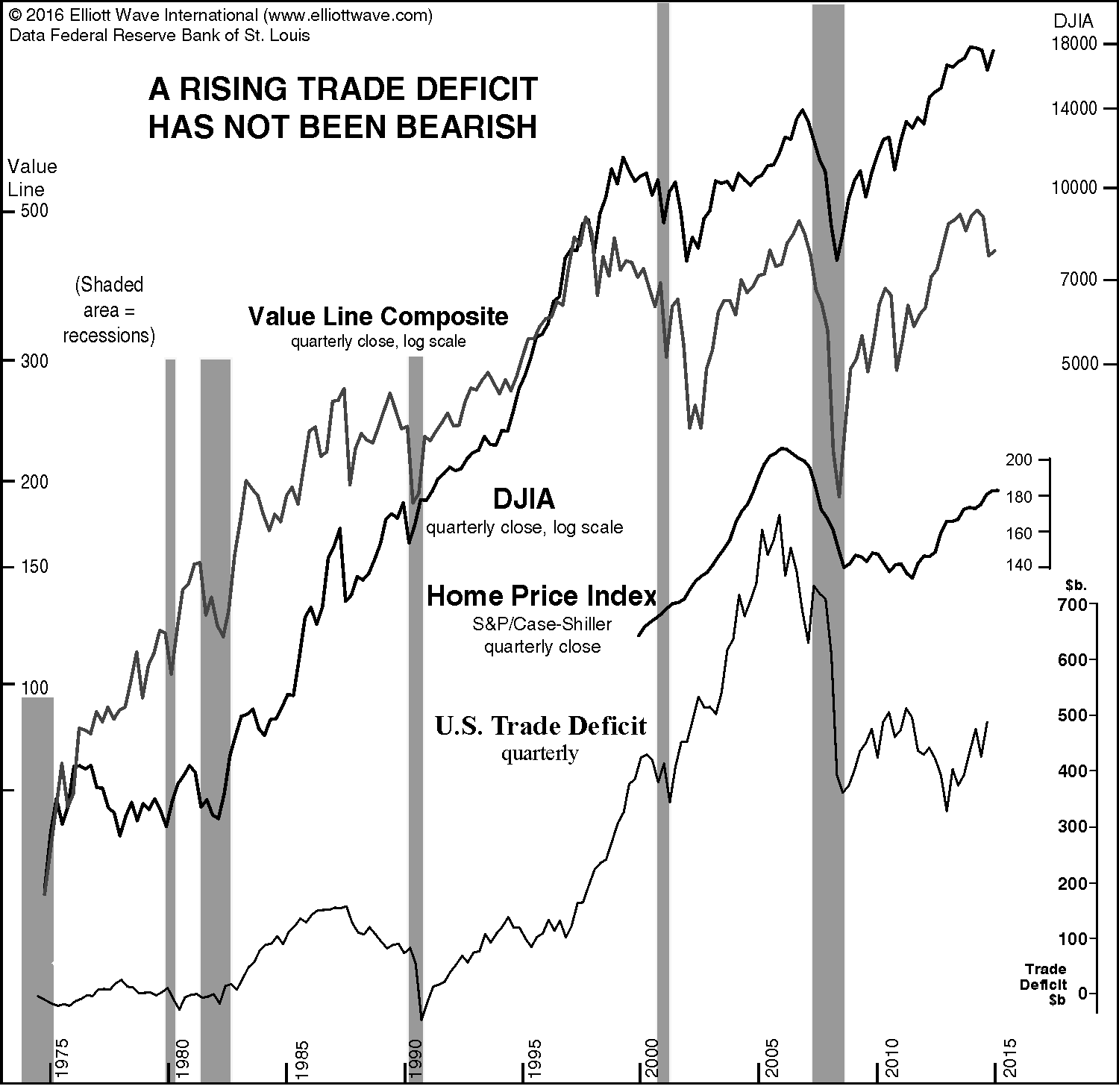

The chart below reveals that had economists expressed relief whenever the trade deficit began to expand and concern whenever it began to shrink, they would have quite accurately negotiated the ups and downs of the stock market and the economy over the past 40 years. The relationship, if there is one, is precisely the opposite of the one they believe is there. Over the span of these data, there has been a consistently positive—not negative—correlation among the stock market, the economy and the trade deficit:

So, the trade deficit’s widely presumed effect is 100% wrong.

It is no good saying, “Well, an expanding trade deficit will bring on a problem eventually.” Anyone who can see the relationship shown in the chart would be far more successful saying that once the trade deficit starts shrinking, it will portend a problem. Whether or not one assumes that these data indicate a causal relationship between economic health and the trade deficit, it is clear that the “sensible” causal assumption upon which most economists have relied throughout this time is invalid.

If you examine the chart closely, you will see that peaks in the trade deficit preceded recessions in every case, sometimes by years, so one cannot blame recessions for declines in the deficit. Something is still wrong with the conventional style of reasoning.

Want Prechter’s current thoughts? Click on the button below to instantly access his new April Elliott Wave Theorist.

Or get more insights into market “myths” by reading the first 2 chapters of The Socionomic Theory of Finance – FREE.