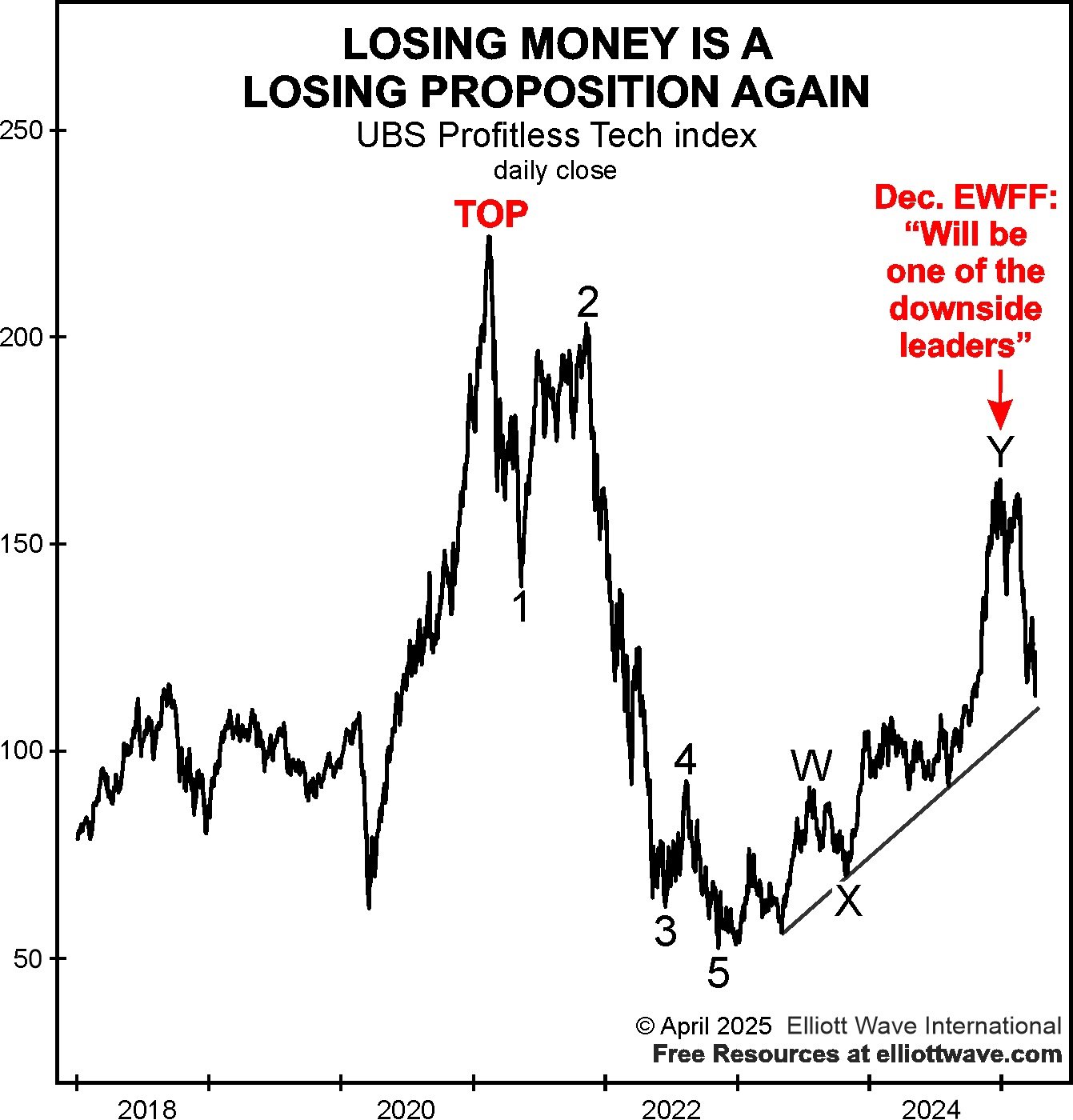

Would you lend money to a ne’er-do-well relative with a history of bad business ventures? Probably not! Yet investors have invested in profitless companies eagerly in recent years. When speculative euphoria takes over, logic goes out the window. Back in December, our Elliott Wave Financial Forecast provided a warning:

The chart below of an index of money-losing tech stocks mimics the basic course of many of the most speculative sectors. On February 5, 2021, with the profitless tech index surging, EWFF showed a version of this chart and titled it “Straight Up Losers.” That turned out to be an accurate description; the index topped out a few days later, on February 11, 2021. After declining 77% to November 2022 in the first phase of its bear market, the profitless tech index retraced 2/3s of its initial decline into mid-December of last year. As the rise into the end of 2024 shows, their lack of earnings nevertheless became a magnet for speculators again at the very end of the bull market. The index is down 32% so far from its countertrend high on December 18. The race to the bottom is on for profitless tech as well as other speculative sectors:

As the old adage goes, “Fool me once, shame on you; fool me twice, shame on me.” Don’t get taken in by Wall Street hype. Get our Elliott wave-based forecast instead.

Do you need a refresher on the details of Elliott wave analysis? We’ve got the resource just for you – and it’s free! Follow this link for instant access to our Elliott Wave Crash Course video now.