Topics:

Asian Markets (37) Commodities (32) Crypto (17) Currencies (24) Economy (106) Energy (15) ETFs (13) European Markets (51) Financial Forecast (1) Futures (1) Interest Rates (56) Investing (203) Metals (29) Short Term Update (1) Social Mood (79) Stocks (184) Trading (157) US Markets (111)

-

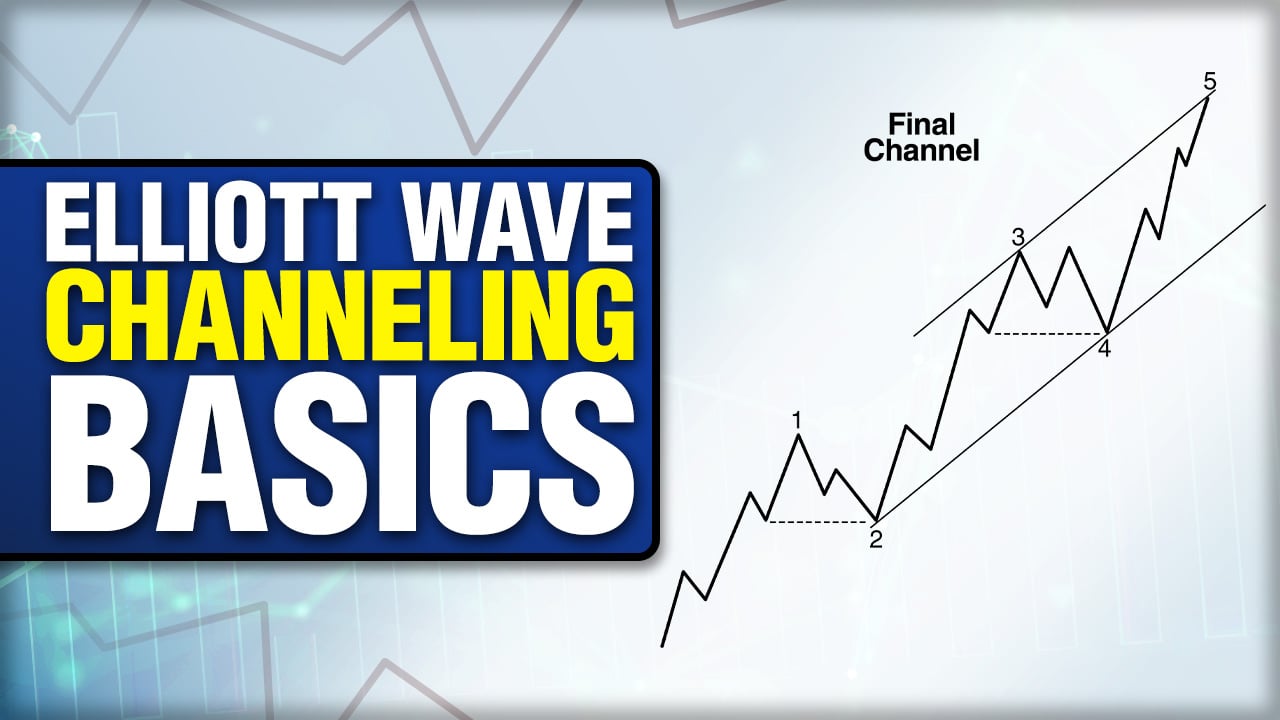

How to Use Elliott Wave Channels in Your Analysis

-

How the EWAVES Engine Nailed the S&P 500 in 2025

-

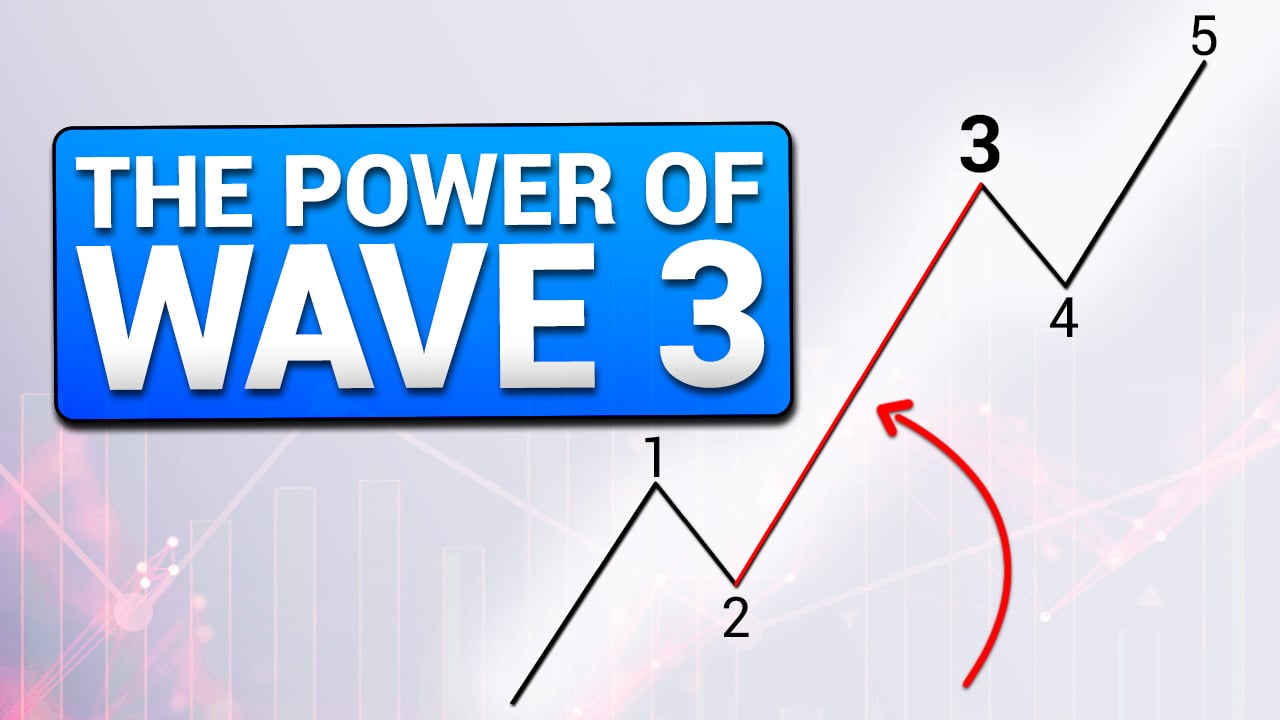

Third Waves Are the Ones You Want to Catch

-

Retail Investors Vs. Warren Buffett

-

Corporate Executives Are Part of the Crowd

-

Houlihan Lokey (HLI): Riding the Trend with Flash and EWAVES

-

EURUSD: What the News Reported After the Fact — and What Our Subscribers Knew in Advance

-

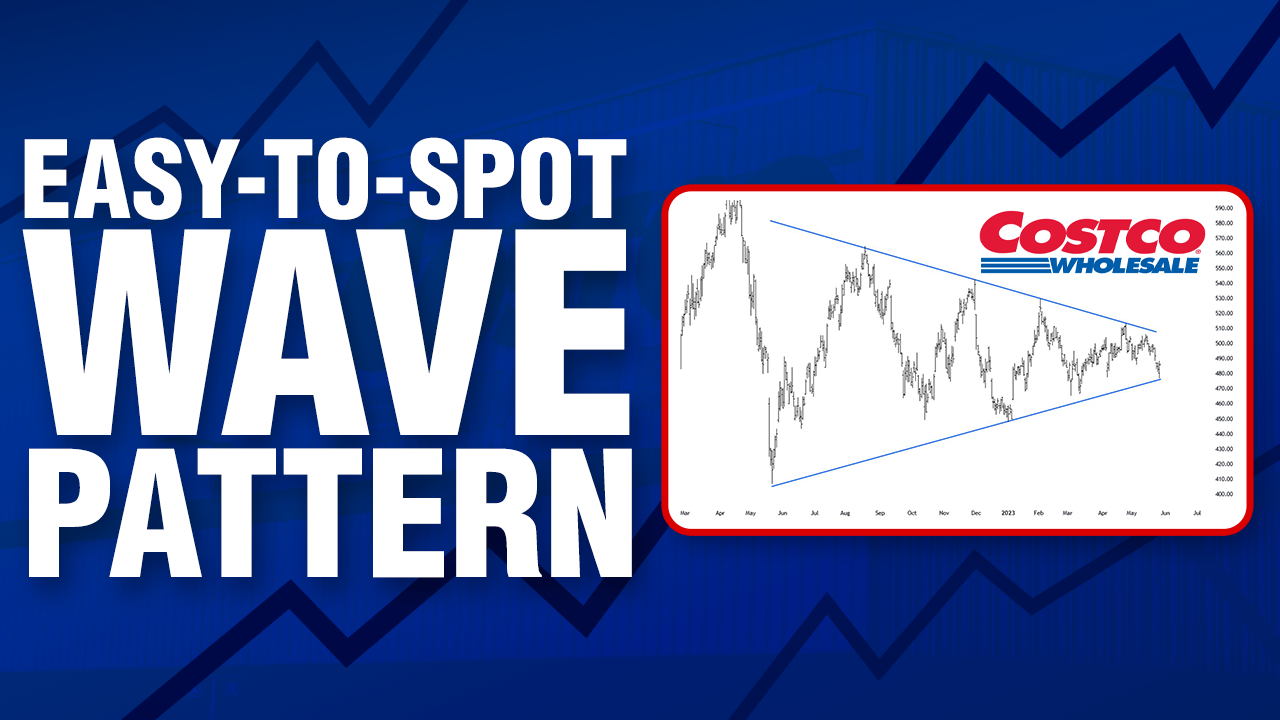

An Elliott Wave Setup You’ll See Again and Again

-

The Perils of Using Earnings to Forecast Stock Prices